Property Valuation Report Format for Loan Purpose

Property Valuation Report Format for Loan Purpose is a standardized way of presenting a property’s details, market value, and legal status to banks or financial institutions when applying for a loan. This report helps lenders assess the property’s fair market value, confirm its ownership, and ensure it is suitable to be kept as collateral. A well-structured report includes property details, valuation date, location analysis, market value calculation, and supporting documents, making the loan approval process smooth and transparent.

Apply for Property Valuation Report for Bank Loan!

Understanding Property Valuation Report Format for Bank Loan Approval

When applying for a home loan or mortgage, the bank needs to be sure that the property you are pledging as security has a fair market value and is legally clear. This is where a property valuation report comes in. It is a professional document prepared by a certified valuer or approved engineer that provides a detailed analysis of the property’s current market value, legal ownership status, location, and physical condition.

The report format is very important because it ensures that all critical information is presented in a clear and structured way that banks can easily review. A typical report includes:

Title Page – Name of the property owner, address, valuer details, and valuation date.

Property Details – Size, type, construction details, and location of the property.

Legal & Ownership Information – Title deed reference, encumbrances, or charges (if any).

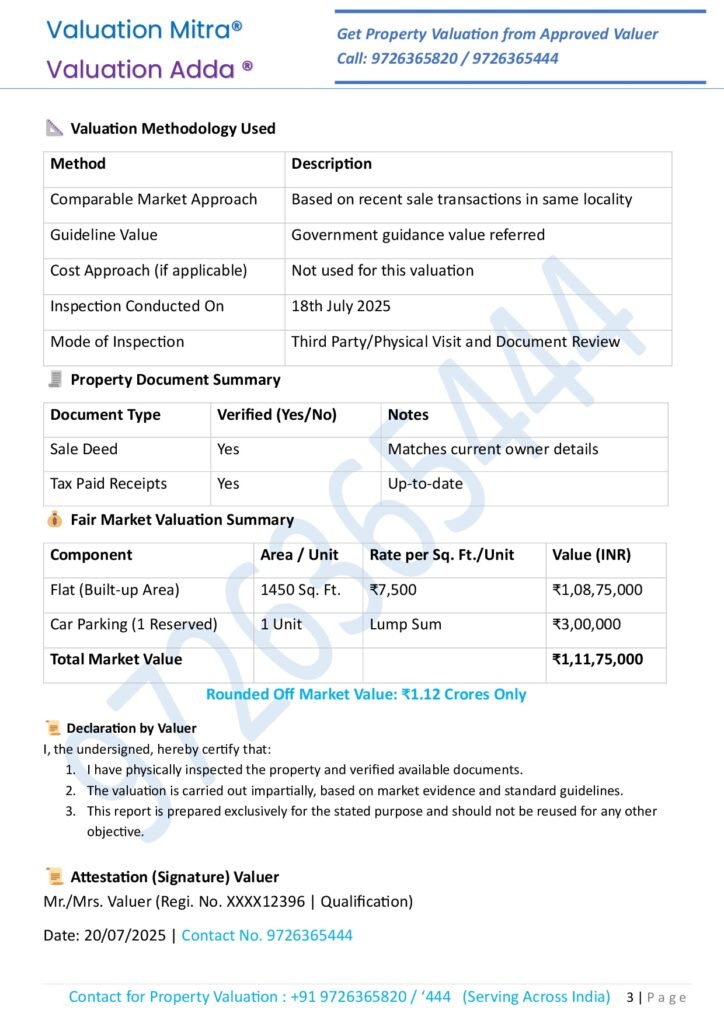

Market Analysis – Comparison with similar properties and prevailing market trends.

Valuation Methodology – Approach used (comparable sales, cost approach, or income method).

Final Valuation & Recommendations – Market value conclusion and comments from valuer.

Annexures – Supporting documents, maps, photographs, and copies of title deeds.

Understanding this format helps you double-check the report before submitting it to the bank, ensuring that nothing is missing and reducing the chances of delays or rejection in the loan process. It also gives you confidence about the fair value of your property, which is helpful for negotiation and financial planning.

Key Sections in a Property Valuation Report for Loan Processing

When applying for a home loan or mortgage, banks require a well-structured property valuation report to assess the property’s value and approve the loan amount. Following a step-by-step format ensures your report is complete, professional, and bank-compliant.

Step 1 – Title Page & Valuer Details

Include the report title, property owner’s name, property address, name and registration number of the valuer, and the valuation date.

Step 2 – Table of Contents

List all sections and annexures with page numbers for quick reference.

Step 3 – Property Identification

Mention survey number, plot number, property type (residential/commercial), area, and location details.

Step 4 – Legal & Ownership Details

Provide title deed references, encumbrance status, and confirm that the property is free from disputes.

Step 5 – Scope of Valuation & Purpose

Specify that the valuation is being done for loan processing and mention the interest being valued (freehold/leasehold).

Top Benefits of Using Purpose-Specific Property Valuation Report Format

Using a purpose-specific property valuation report format ensures that your report meets the exact requirements of the situation — whether it’s for a bank loan, capital gains tax calculation, property sale, or legal settlement. A tailored format helps avoid missing information, improves accuracy, and speeds up approvals.

Here are the main benefits:

Better Compliance – Includes all sections required by banks, tax authorities, or courts depending on the purpose.

Faster Approvals – Well-structured and purpose-ready reports reduce queries and speed up loan or tax processing.

Clarity & Transparency – Presents data in a clear, professional way that is easy for lenders, buyers, or tax officers to review.

Error Reduction – Purpose-specific formats ensure no key detail (like valuation date or title reference) is missed.

Professional Impression – Standardized and clear reports increase credibility with institutions and authorities.

Saves Time & Effort – Easy to prepare and review, reducing back-and-forth communication.

Better Decision-Making – Gives stakeholders confidence in the property’s value for loans, investments, or tax planning.