Property Valuation Report Format for Buy Sell Property

Property Valuation Report Format for Buy Sell Property is a structured way to present the property’s details, legal status, and fair market value when buying or selling real estate. This report helps buyers know the correct price of a property and gives sellers a clear, professional document to justify their asking price. A proper format includes property identification, location analysis, valuation method, and supporting documents, ensuring transparency and smooth transactions for both parties.

Get Valuation Report in Customized Format for Your Needs

Standard Property Valuation Report Format for Buying and Selling Property

A standard property valuation report format is essential for ensuring transparency and fairness during a property sale or purchase. This report provides a clear, professional assessment of a property’s market value, legal status, location, and physical condition, helping both buyers and sellers make informed decisions.

A typical format includes:

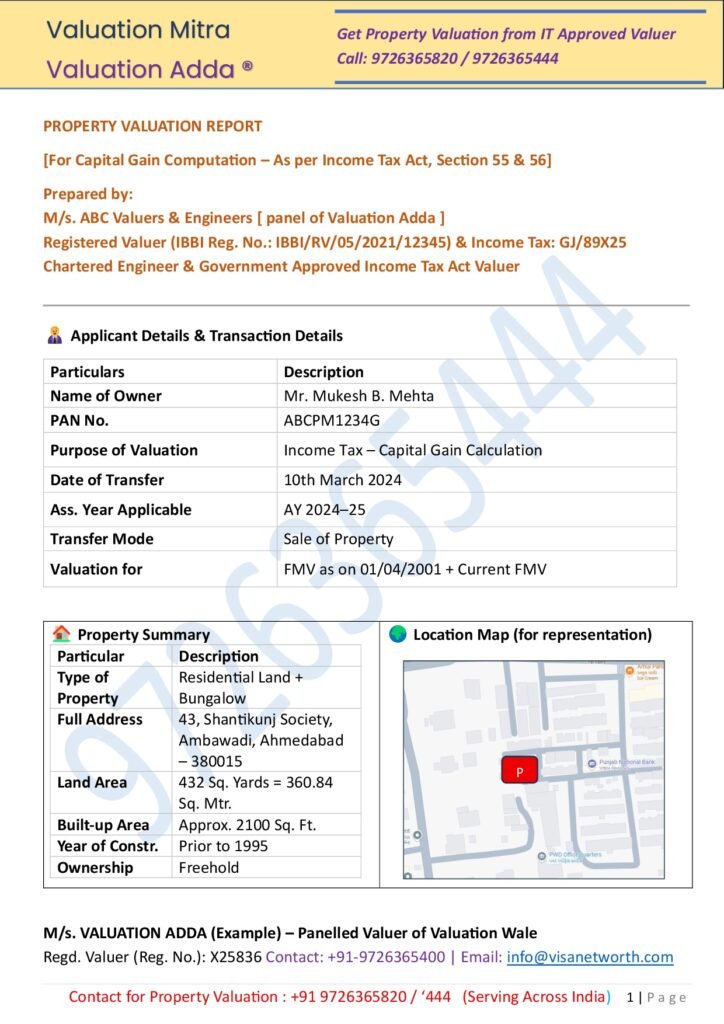

Title Page & Valuer Details – Name, registration number, date, and purpose (buy/sell transaction).

Property Identification – Address, survey/plot number, type of property, and area details.

Legal Ownership Status – Title deed reference, encumbrances, and confirmation that the property is dispute-free.

Property Description – Land size, building specifications, age, amenities, and condition.

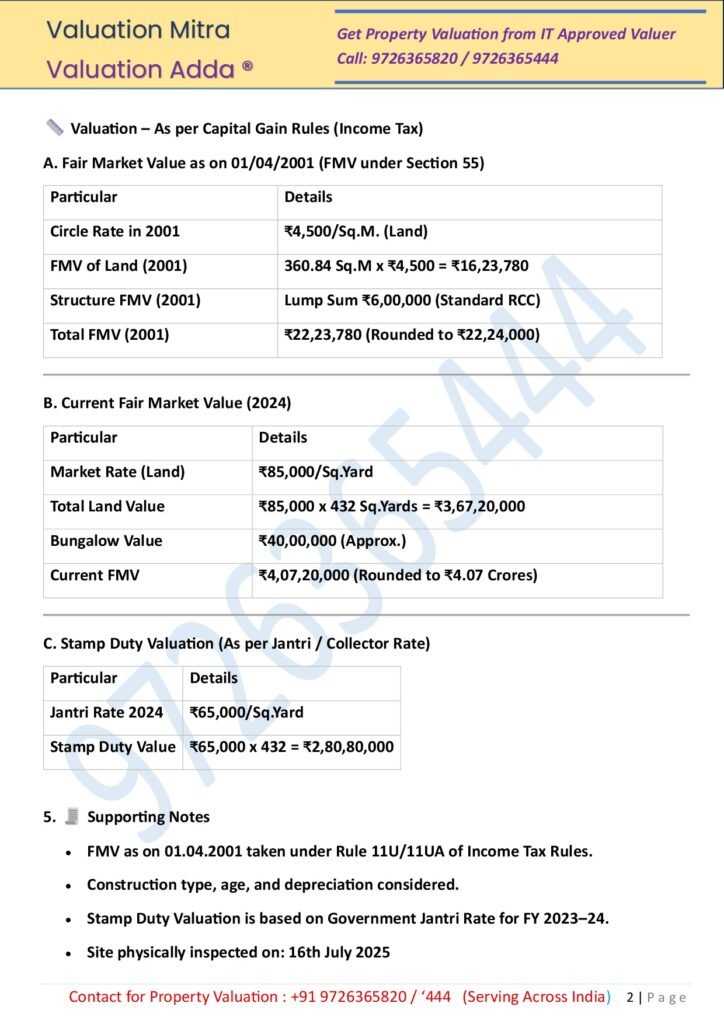

Market Analysis – Locality review and comparable sale data to justify the value.

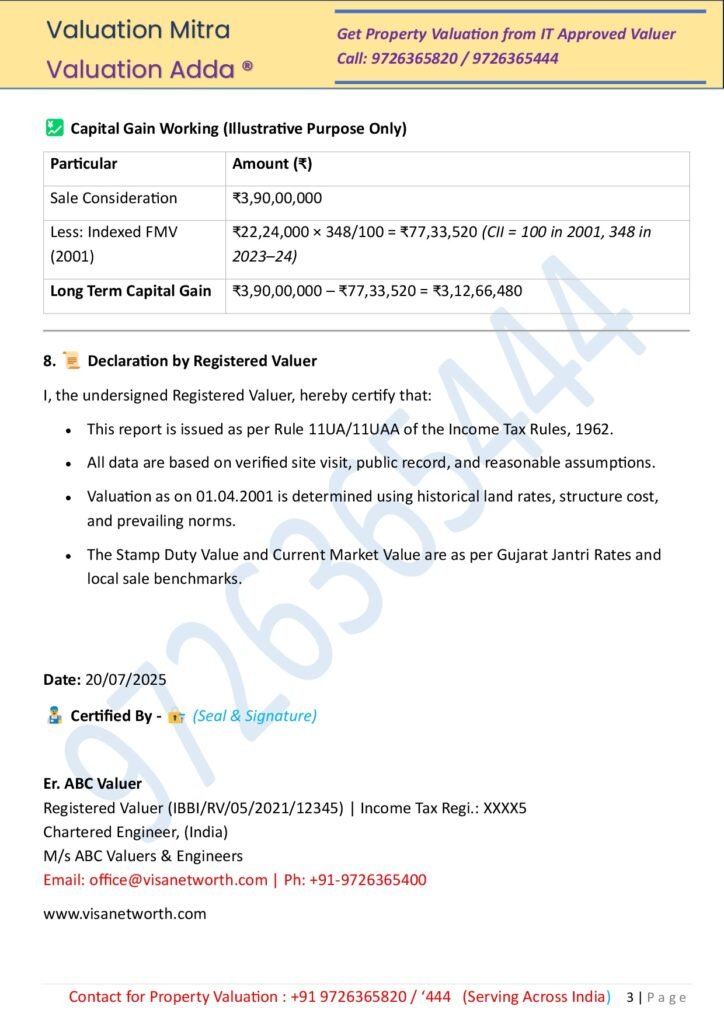

Valuation Method & Final Value – Approach used (sales comparison, cost approach, etc.) and final market value.

Annexures – Photographs, maps, and copies of supporting documents.

Following this standardized format ensures that the valuation is clear, compliant, and acceptable to buyers, sellers, and even financial institutions. It builds trust and helps avoid disputes over pricing during negotiations.

Why Valuation is Important in Real Estate Transactions

Property valuation is a key step in any real estate transaction because it provides an unbiased estimate of a property’s true market value. Whether you are buying, selling, or mortgaging a property, an accurate valuation ensures transparency and protects the financial interests of all parties involved.

Here’s why it matters:

Fair Pricing – Helps buyers avoid overpaying and sellers set a realistic, competitive price.

Better Negotiation – Provides a strong basis for price discussions backed by market data.

Loan Approval – Banks use valuation reports to decide how much loan can be sanctioned.

Legal & Tax Compliance – Correct valuation is needed for stamp duty, registration, and capital gains tax.

Investment Decisions – Helps investors compare properties and choose the best opportunity.

Risk Reduction – Identifies legal issues, encumbrances, or overvaluation risks before closing the deal.

In short, property valuation builds trust between buyers, sellers, and lenders, ensuring a smooth and dispute-free real estate transaction.

Role of a Valuation Report in Price Negotiation

In real estate negotiations, a valuation report acts as a trusted reference point, giving both buyers and sellers a clear, unbiased view of a property’s fair market value. It helps sellers justify their asking price and buyers make informed offers based on data rather than guesswork. By including market trends and comparable sales, the report speeds up discussions, reduces conflicts, and ensures a fair outcome for both parties.

Sets a Realistic Benchmark – Gives both buyer and seller a clear starting point for discussion.

Avoids Overpricing or Underpricing – Prevents disputes by showing a fair, professionally assessed value.

Strengthens Negotiation Position – Buyers can justify offers, and sellers can defend their asking price with proof.

Supports Faster Deal Closure – With a trusted valuation, agreements are reached more quickly.

Provides Transparency – Encourages fair transactions and builds confidence between parties.

In short, a valuation report is not just a document — it is a powerful negotiation tool that ensures both sides get a fair deal.

Benefits of Using a Proper Report Format

Using a proper report format for property valuation ensures that all the necessary details are presented in a clear, professional, and organized way. A well-structured report helps buyers, sellers, and lenders quickly find the information they need, reduces the chance of missing key data, and builds trust between all parties involved.

Key benefits include:

Clarity and Consistency – Information is easy to read and understand.

Compliance – Meets the requirements of banks, tax authorities, and legal standards.

Faster Processing – Reduces back-and-forth queries, saving time during approvals.

Professional Appearance – Creates a credible impression for buyers, sellers, and lenders.

Reduced Errors – Ensures no section or calculation is accidentally left out.

Better Decision-Making – Helps all parties make informed choices based on accurate data.

In short, a proper format makes the report clear, complete, and reliable, resulting in smoother transactions and quicker approvals.