Property Valuation Report Format for Capital Gain

Property Valuation Report Format for Capital Gain is an essential document required when you sell a property and need to calculate your capital gains for tax purposes. This report provides an accurate estimation of your property’s fair market value, which helps determine the cost of acquisition and ultimately the taxable capital gain. A properly structured valuation report includes details such as property description, ownership information, valuation date, methodology used, and the final assessed value certified by a registered valuer. Having the correct format ensures compliance with tax laws and avoids disputes during income tax assessment.

Need Valuation Report for Capital Gains ?

Understanding Property Valuation Reports for Capital Gains Tax

A property valuation report is a detailed document prepared by a certified valuer that determines the fair market value (FMV) of a property as on a specific date. This report plays a crucial role in calculating capital gains tax, especially when you sell or transfer property.

For capital gains purposes, the valuation report helps establish:

The cost of acquisition or fair market value (if the property was acquired before a specified base year, such as 2001–02 in India).

The indexed cost for computing long-term capital gains accurately.

A legally recognized value that is accepted by tax authorities during scrutiny or assessment.

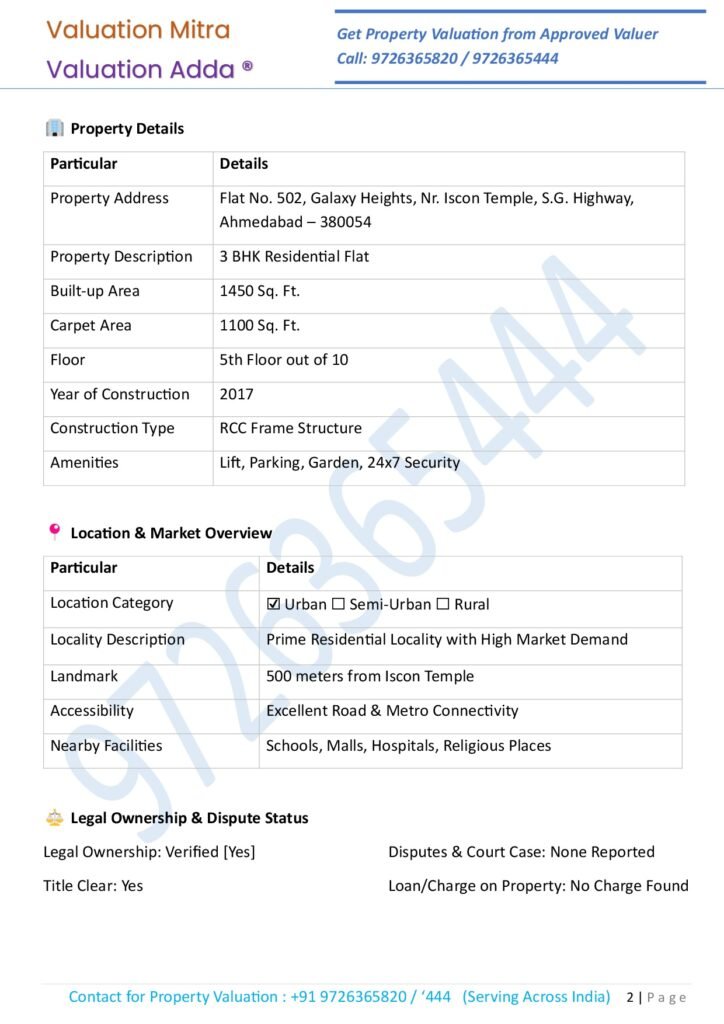

Typically, a property valuation report includes property details (address, type, size), legal ownership records, valuation method used (comparable sales, income approach, or cost method), and the valuer’s certification with date and signature.

By understan ding how these reports work, taxpayers can ensure accurate capital gains calculation, avoid disputes with tax authorities, and stay compliant with income tax laws.

Key Components of a Property Valuation Report

A well-prepared property valuation report follows a standard format and includes all the necessary details required by tax authorities for capital gains calculation. Below are the key components that make the report complete and reliable:

Title & Purpose – Clearly mention it is for capital gains calculation.

Property Details – Address, type, size, and usage.

Ownership Info – Owner’s name and legal documents.

Date of Valuation – Relevant date for FMV calculation.

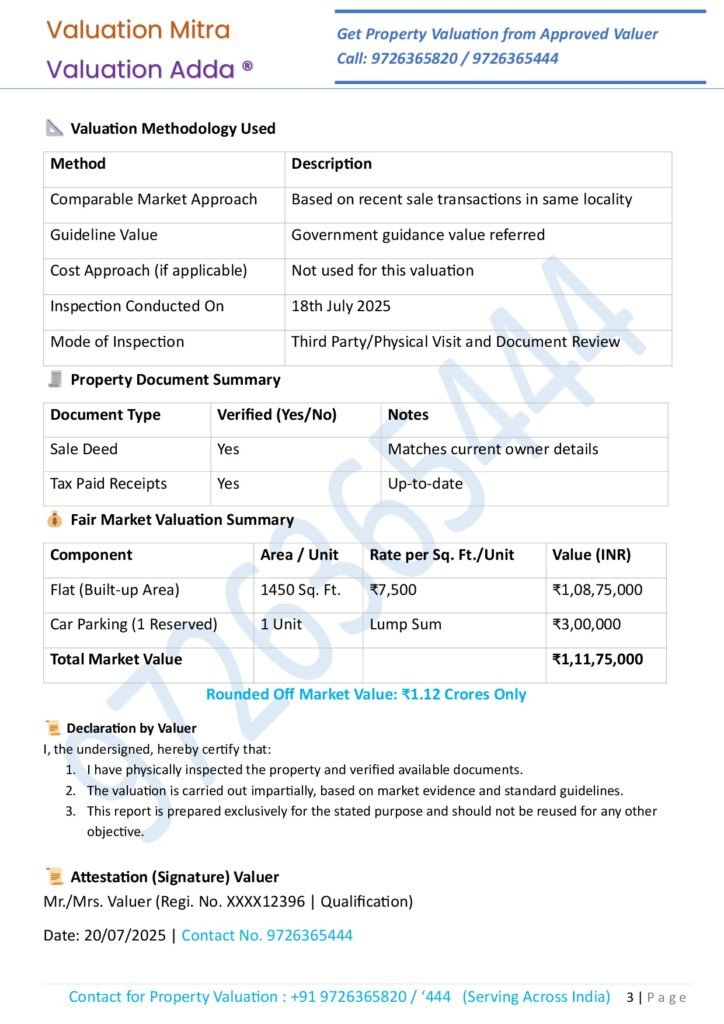

Valuation Method – Comparable sales, cost, or income approach.

Fair Market Value (FMV) – Final assessed value.

Supporting Data – Market rates or sale comparables.

Valuer’s Certification – Registered valuer’s name, seal, and signature.

Annexures/Photos – (Optional) for reference and clarity.

This ensures the report is complete, credible, and tax-compliant.

Purpose of Using a Standard Format for Capital Gain Tax

Using a standard format for property valuation reports ensures consistency, accuracy, and compliance with tax regulations. When reporting capital gains on the sale of a property, tax authorities often require a professionally prepared report that follows a recognized structure.

A standard format serves several purposes:

Ensures Legal Compliance – It aligns the valuation report with income tax rules, preventing disputes with tax authorities.

Provides Transparency – Clear, uniform sections make it easy for tax officers to verify the computation of indexed cost, fair market value, and final capital gain.

Facilitates Comparability – Standardized data presentation helps compare property values across cases or years, supporting fair assessment.

Reduces Errors – Following a set structure minimizes omissions of critical details like date of acquisition, improvements, and deductions.

Enhances Credibility – Reports in a professional, recognized format are considered more reliable and defensible during scrutiny.

Saves Time – Both taxpayers and authorities can process and understand standardized reports quickly, speeding up assessments.

In short, a well-structured valuation report format ensures your capital gain calculation is accurate, compliant, and audit-ready.

Importance for Capital Gains Calculation

A proper property valuation report is very important for calculating capital gains correctly.

Finding the Right Value – Shows the fair market value of the property on the required date.

Correct Tax Calculation – Ensures capital gain is computed as per income tax rules.

Using Indexation – Helps apply the right cost inflation index to get accurate indexed cost.

Avoiding Disputes – Gives a clear and well-documented basis that tax officers can verify.

Supporting Claims – Acts as proof if there is a query or audit from tax authorities.

Better Tax Planning – Knowing the exact capital gain helps plan exemptions and savings.